If you’ve paid higher rate tax in the last four tax years, or are a higher rate taxpayer currently, and you’ve made pension contributions, then you may be entitled to additional tax relief on your pension contributions. This article outlines how pension tax relief works, who needs to claim higher rate relief, how to figure out what you’re owed and how to claim your money.

How it works

Assuming that certain conditions are met, pension contributions are often the best way to create long-term financial security, through incredible tax efficiency. Pension contributions attract tax relief at your marginal rate, lets see what that looks like in practice.

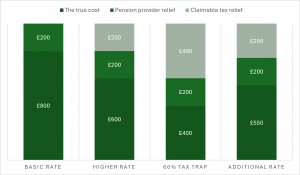

The basic rate taxpayer pays in £800 to their pension, the pension provider claims £200, and they now have £1,000 in their pension, with a net cost of £800.

The higher rate taxpayer also pays £800 in their pension, the pension provider claims £200. Then they claim tax relief directly from HMRC, in this case worth £200. £1,000 in their pension, cost them £600.

An additional rate taxpayer would claim a further £50 of tax relief, so £1,000 in their pension, cost them £550.

For those with net income between £100,000 and £125,140, the tapering of the personal allowance means they have an effective marginal income tax rate of 60%. A pension contribution is really tax efficient, an £800 contribution attracts basic rate tax relief of £200, and they claim tax relief of £400. £1,000 in their pension cost them £400.

The caveat

The additional tax relief can only be claimed up the start of your basic rate band. If you have a net income of £55,000, and you make a pension contribution of £10,000, you can only claim the additional tax relief on the portion of that contribution above £50,270 of net income. In this instance that’s £4,730, so that’s £946 of higher rate tax relief, to go with the £2,000 of basic rate tax relief applied for by your pension provider.

Who needs to claim the tax relief

Personal contributions to a private pension mean the pension provider claims basic rate tax relief for you; but you need to claim the additional tax relief yourself. You are eligible to claim this relief if your net income (adjusted net income) takes you into the higher rate tax band for the year that you made pension contributions.

If your company or employer is making pension contributions on your behalf then you cannot claim additional tax relief, as the tax relief has been applied already. Additionally, if your workplace pension is a salary sacrifice scheme then the full tax relief is applied automatically to your pension, and you don’t need to claim your tax relief from HMRC.

However, many people don’t realise that their workplace pension isn’t a salary sacrifice scheme, or under the net pay basis, and the tax relief is paid at source, meaning they need to claim the additional tax relief themselves.

Claiming your tax relief

You can claim tax relief on pension contributions for up to the previous four tax years. The current tax year is 2025/26 which means tax relief can be claimed for the 2021/22, 2022/23, 2023/24, and 2024/25 tax years. If you miss it and leave it unclaimed, it is gone. So, you need to act.

You can claim your tax relief via your self-assessment tax relief, or by filling out a form via your government gateway account. You should have evidence of the pension contributions, your pension policy number and the pension tax scheme reference number which your pension provider will offer.

*Pension contributions are limited to 100% of relevant earnings or subject to your annual allowance, carry forward contributions may apply.

* Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

*A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available.

*Workplace Pensions are regulated by The Pensions Regulator.

Get in touch

We’d love to hear from you.

By contacting Wealth Spring you confirm you have read our privacy notice, which can be found here.